Reporting Requirements for Recipients of the Provider Relief Fund

Important Updates:

On September 10, 2021, the HHS announced a 60-day grace period to help providers come into compliance with the PRF reporting requirement if they are required to and fail to meet the first reporting deadline of September 30, 2021. The deadline to use the funds and reporting time period will not change. The grace period begins on October 1, 2021 and will end on November 30, 2021. This grace period applies only to the first reporting deadline.

On September 10, 2021, the HHS announced another round of funding; a phase 4 general distribution and a rural provider distribution. Details can be found here.

Congress provided relief for Americans, businesses, and healthcare institutions through a record stimulus deal in response to the COVID-19 pandemic with the Coronavirus Aid, Relief, and Economic Security Act (CARES).

Healthcare providers and facilities were granted financial relief through the Provider Relief Fund (PRF), which was established through the CARES Act. The U.S. Department of Health & Human Services (HHS) was tasked with coordinating this financial assistance. As of this date, the HHS has issued 3 phases of general and targeted distributions for those providers and facilities that were hardest hit. As with any relief, the government is assigning responsibility to report on the use of these funds.

HHS has published a list of recipients, which can be found here. Recipients can reference this list to confirm the amount received.

As of June 11, 2021, the HHS has updated the reporting requirements.

For those recipients who received $10,000 or less, there is no reporting obligation.

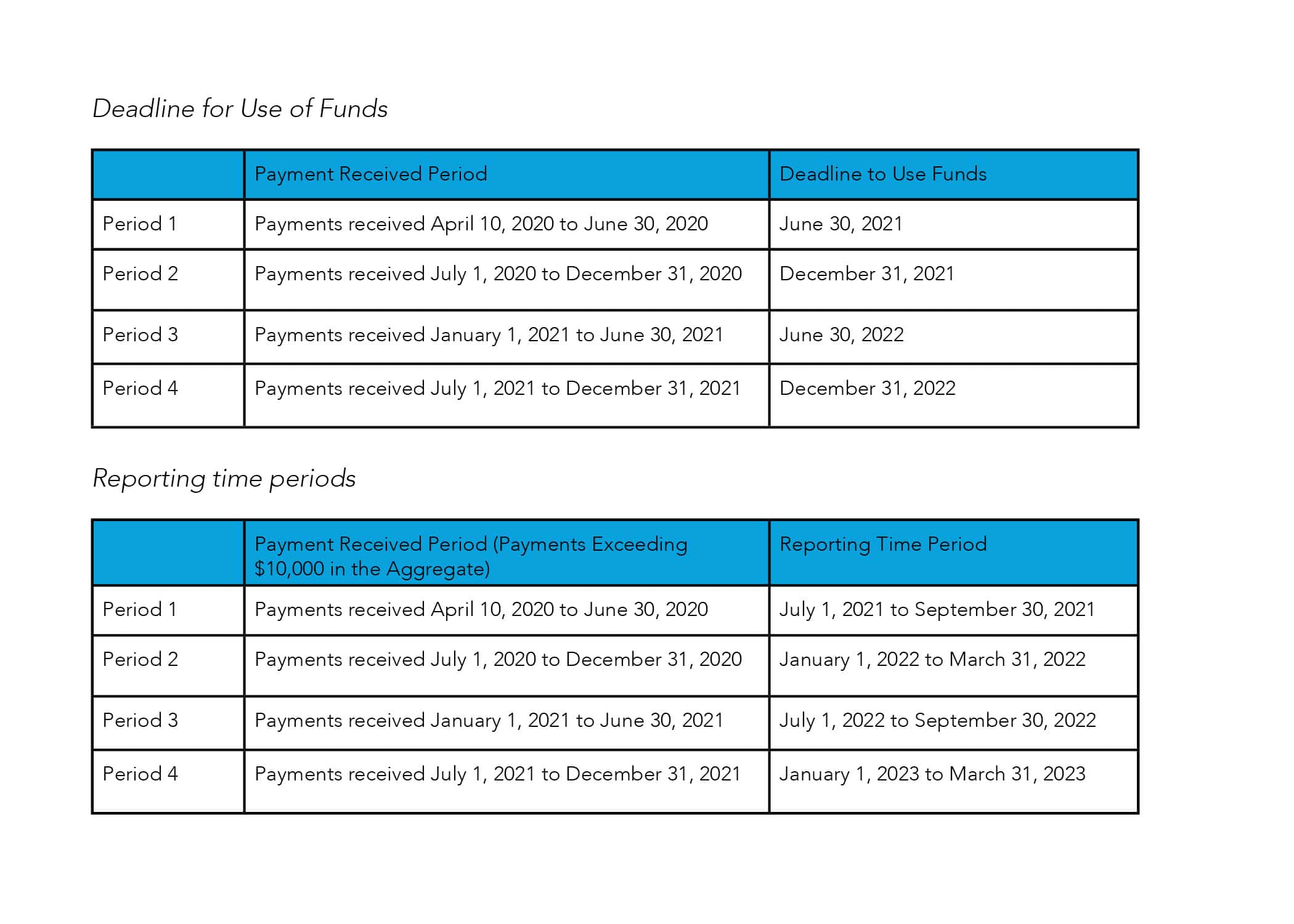

For those recipients who received more than $10,000, the HHS has established deadlines for disbursing the funds and for reporting on the use of those funds. Any recipient who cannot confirm appropriate use of those funds by the posted due date may be subject to repayment of those funds. HHS has also advised that all recipients could be subject to audit.

HHS has identified four periods for use and reporting requirements as outlined below:

PRF recipients that receive one or more payments are required to report in the reporting time period associated with the date in which they received payments that exceed $10,000 in aggregate.

Recipients that received and spent $750,000 or more are required to comply with Single Audit requirements.

Detailed guidance and due dates can be found here.

Registration is now open for reporting. Recipients must register at the Provider Relief Fund Reporting Portal. This is a different portal from the attestation portal that was used when the funds were originally deposited. This is also different from the portal used to apply for the Phase 3 distribution. Recipients can access the reporting portal here.

KHA recommends that if recipients are subject to this reporting requirement that they register as soon as convenient.

KHA has established a team of professionals within our healthcare industry specialization that have focused time in understanding these reporting requirements. We are positioned to assist with this process. Please do not hesitate to reach out to KHA with any additional questions you may have.

For general information on HHS reporting and auditing, please visit: https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/reporting-auditing/index.html

For answers to frequently asked questions regarding the CARES Act Provider Relief Fund, please visit: https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/faqs/index.html

As your trusted advisors, we are committed to keeping you well-informed with regard to HHS and financial relief offered for healthcare providers and facilities. Please sign up for updates as we will continue to publish information on any new relief targeted at the healthcare industry.

These sources are simply included for informational purposes. KHA Accountants, PLLC, its partners and others do not provide any assurance as to the accuracy of these items or the information included therein. As such, KHA Accountants, PLLC cannot be held liable for any information derived from referenced sources. This is intended for illustrative and discussion purposes only.

Fill out the form below to contact the KHA team to assist you with your Provider Relief Fund Reporting.